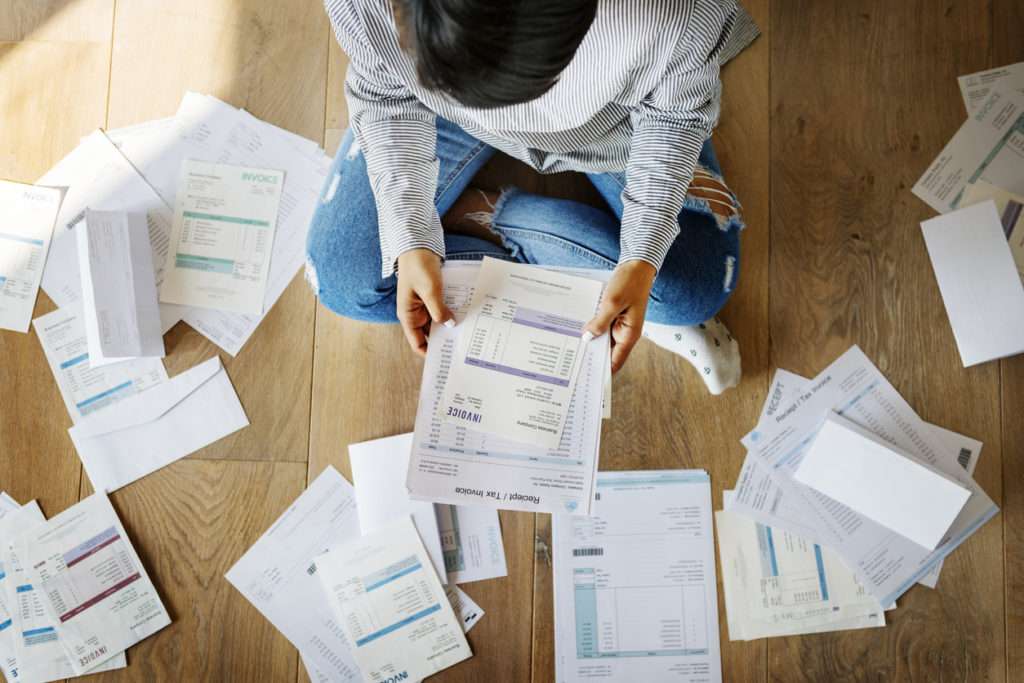

The number of single-person households is on the rise in the UK, but what is the cost of living alone and is it much more expensive than living as part of a couple?

According to ONS figures, people living alone spend an average of 92% of their disposable income, compared with two-adult households who spend only 83% of their disposable income.

It is also more common for solo living people to rent their homes, and it can be more challenging to secure a mortgage on a single salary. 50% of 25-64-year-olds who live alone in the UK own their own home compared to 75% of the same age group who are couples living without children.

With around eight million single-person households in the UK today, solos can feel that life is more expensive for them than for an average couple sharing a home.

The Cost Of Living Alone

Living Alone | updated 1st October 2023 by Michelle Newbould

The number of single-person households is on the rise in the UK, but what is the cost of living alone and is it much more expensive than living as part of a couple?

According to ONS figures, people living alone spend an average of 92% of their disposable income, compared with two-adult households who spend only 83% of their disposable income.

It is also more common for solo living people to rent their homes, and it can be more challenging to secure a mortgage on a single salary. 50% of 25-64-year-olds who live alone in the UK own their own home compared to 75% of the same age group who are couples living without children.

With around eight million single-person households in the UK today, solos can feel that life is more expensive for them than for an average couple sharing a home.

Where does the money go?

According to data from the ONS, one-person households spend more on food and furnishings. Many solos believe that more of their spare cash is spent on entertainment and socialising because it can be easier for couples to stay in to enjoy each other’s company.

For a single person living alone, it is more common for them to go out to meet friends and socialise, which means you go out more often and spend more money on drinks, food and entertainment.

Living alone can also leave you with less spending money at the end of the month because you have to pay your rent or mortgage and all the household bills yourself.

How the cost of living becomes more expensive for singles

Here are a couple of examples. Many gym memberships are also geared up for couples rather than single people, with most offering a discount price for a couple where a single person will be expected to pay full price.

You can save a little money at home by being single, as you will qualify for a council tax reduction. However, even though you get a 25% discount on your council tax if you are a single-household, it puzzles solos why it is only 25% and not a 50% discount, because they would only be paying half of a council tax bill if they were part of a couple, and not 75%.

Holiday expense comparisons

Going away on holiday is also cheaper for couples as they won’t be charged the dreaded single supplement on hotel rooms.

In response, hotels maintain there is still a lot of work involved in maintaining hotel rooms, laundry, cleaning, heating etc. whether there are one or two people occupying, so you can see how charging a single supplement can be justified in some respects.

You also have to realise that hotels and holiday resorts work on a budget that assumes couples will spend more money in their hotel bar, restaurant, spa, and room service. Extra charges for single travellers are added to make up for the amount of money the hotel or resort might lose from your booking. Whether solos would agree with this analysis, is a matter for discussion.

Another way solo travel can prove more expensive is when hotels, airlines and holiday companies include an administration fee in their prices. For example, when booking a single ticket, you will be paying for the full administration fee by yourself. But if you buy two or more tickets, this administration fee will be spread over the cost of the tickets.

Economies of scale

Because so many products and services are geared toward couples and families, this is how the cost of living can become higher for people living alone. For example, car insurance is cheaper for a couple because you can put your husband or wife on your policy as the second driver.

Insurance companies judge risk when setting prices, and claim histories suggest that people who settle down as a couple in a stable relationship are more likely to be safer drivers than single people.

The theory is that by adding your partner as a second driver, you can lower your insurance premium by spreading the risk. So a single person will spend more money on the same things because they appear a higher risk, even if this isn’t true in real life.

Tax breaks for married couples

Singles also miss out on tax breaks and other financial benefits geared towards married couples.

Firstly, you can qualify for a marriage tax allowance as a married couple. If one of you is a base-rate taxpayer, and the other is earning less than £11,500 per annum, the partner on the lower income can transfer £1,150 of their Personal Allowance to their spouse. This can save the couple up to £230 a year.

Inheritance is another area where married couples benefit. Any inheritance between spouses is free from inheritance tax. However, if you leave your estate to anyone else, it will be taxed at 40% above £325,000.

You can also inherit the deceased partner’s tax-free band, so when the second partner dies, any child can inherit up to £650,000 completely tax-free.

Married couples can also benefit from final salary pensions. This is where a spouse’s pension death benefits are paid to the surviving partner. But this doesn’t extend to other family members such as your children or siblings.

With the continuing rise in single-person households, it can be regarded as unfair that solos should continue to live in a world and a society that is seen to favour marriage. Many singles hope that as society evolves, we will see more of a shift towards treating people with greater equality.

Single-households expected to increase

According to figures from the ONS, the number of people living on their own went up by 16% to 7.7 million between 1997 and 2017, and the number of one-person households is projected to rise to 10.7 million by 2039.

A growing number of people are also choosing to stay single and live alone rather than cohabit with a partner. In fact, single-households are the fastest-growing demographic in the world, with almost 8 million one-person households in the UK and 300 million globally.

Whether it was through choice or circumstance that got us here, going solo presents many challenges but also provides numerous benefits that we wouldn’t exchange easily. Even after years of living with a partner, many solos have come to cherish living alone.

If there are three things people would find hard to give up from the living alone experience it would be the freedom, independence and the lack of need for compromise.

You learn a lot about yourself and live beyond other people’s stereotypes or judgments that try to define you. Living alone can empower you to become a strong, independent person who not only brings home the bacon but will turn it into the most mouth-watering BLT.!

So, yes. the cost of living alone can be more expensive than living as part of a couple. With the current cost of living crisis putting pressure on our purses and wallets, it may seem tempting to become coupled up to ride out this financial storm, but it may not be worth the expense of what you will lose from your life by doing so.

Read more on the cost of living alone:

Share this post:

Hear from Solo Living now and then by signing up to our mailing list